The bond offers a return anywhere between 7. This set of investors comes under Category IV. Your Reason has been Reported to the admin. After logging in you can close it and return to this page. An offering from NTPC had witnessed a similar demand, clocking 11 times bids on the opening day itself and forcing the state-run power company to pre-close the issue on September

| Uploader: | Sakazahn |

| Date Added: | 9 January 2015 |

| File Size: | 39.78 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 67334 |

| Price: | Free* [*Free Regsitration Required] |

These are usually issued by government-backed entities. Cree check the bond prices. General Insurance Corporation of India. While bank FDs attract income-tax as per the standard tax slabs 10 per cent, 20 per cent and 30 per centtax-free bonds allow income-tax exemptions on long-term investment gains. Any word on tax free bonds? Last month, the NHAI bond issue got subscribed 22 times.

My Saved Articles Sign in Sign up. An offering from NTPC had witnessed a similar demand, clocking 11 times bids on the opening day itself and forcing the state-run power company to pre-close the issue on September Choose your reason below and click on the Report button.

Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. To see your saved stories, click on link hightlighted in bold.

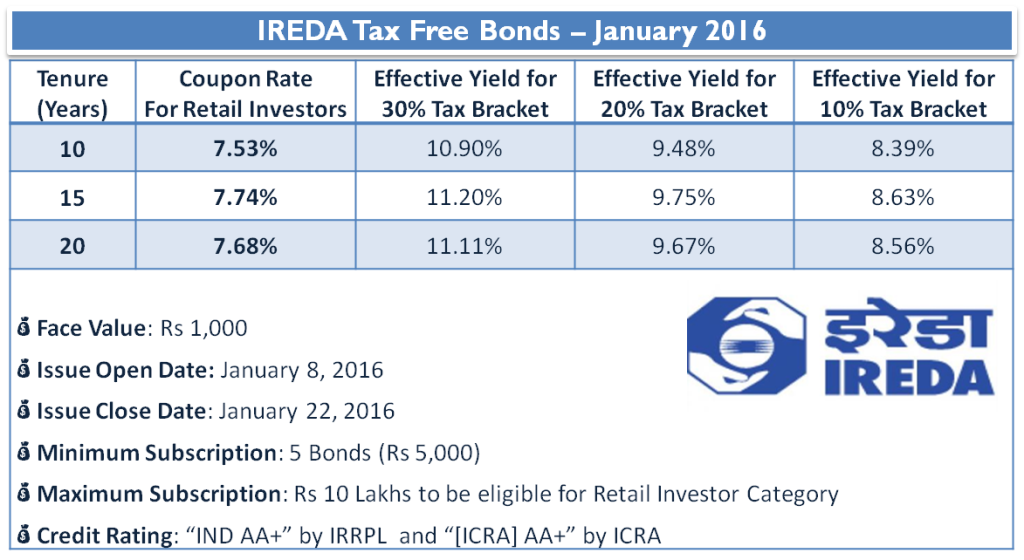

IREDA Tax Free Bonds - Jan

The bond was sold between December 8 and December 10, but got oversubscribed within a few hours of its opening. The bond offers a return anywhere between 7. The main aim of his blog is to "help investors take informed financial decisions. Technicals Technical Chart Visualize Screener. This will alert our moderators to take action Name Reason for reporting: These funds are utilized to fund infrastructure projects.

After logging in you can close it and rax to this page. Tax-free bond issues of public sector companies have witnessed huge interest among both retail and non-retail investors in recent times.

Sreekanth is the Man behind ReLakhs. The issue will close for subscription on January Fill in your details: Click here for real-life stories of successful ureda. Also, any past bonds available with discount in secondary market? Just like bank fixed deposits FDstax-free bonds offer fixed interest to subscribers. Each bond is valued at Rs 1, and investors have to bid for a minimum of five bonds. The login page will open in a new tab. Thus the total offering to retail investors will increase from Rs crore to Rs Session expired Please log in again.

On bonds maturing over 15 years, retail investors would get 7.

Read more on BSE. Please log in again.

IREDA - Tax Free Bonds

Let us first understand, hax is a Bond? While the mini-ratna company will be looking to raise Rs 1, crore from the issue, it may consider retaining oversubscription of up to Rs crore, aggregating to Rs 1, crore, the company said.

Never miss a great news story! Forex Forex News Currency Converter. Find this comment offensive?

Комментарии

Отправить комментарий